Understanding the Essential Mechanics of UK Mortgages

Securing a mortgage is often the most significant financial commitment many Britons will make in their lifetime. Understanding how mortgage works in the UK is important for anyone stepping onto the property ladder or considering refinancing their existing home loan. This comprehensive guide explores everything you need to know about the UK mortgage landscape, from application processes to repayment strategies.

Key Takeaways:

- A mortgage is a secured loan specifically for property purchase, with the property serving as collateral

- UK mortgages typically run for 25-35 years with various interest rate structures available

- The application process involves affordability assessments and property valuations

- Understanding the difference between repayment and interest-only mortgages is essential

- Early repayment charges and fees can significantly impact the total cost of your mortgage

The Fundamentals: What is a Mortgage?

At its core, a mortgage is a specialized loan designed specifically for property purchases in the UK. When you take out a mortgage, you’re entering into a legal agreement with a lender who provides the funds needed to buy a property. In return, you commit to repaying this amount, plus interest, over an agreed period—typically 25 to 35 years in the UK market. The distinctive feature of a mortgage compared to other loans is that the property itself serves as security (collateral) for the loan.

According to recent data from UK Finance, approximately 66% of UK homes are purchased using a mortgage, highlighting how integral these financial products are to the housing market. The total value of outstanding residential mortgages in the UK exceeded £1.6 trillion in 2023, representing a significant portion of the UK economy.

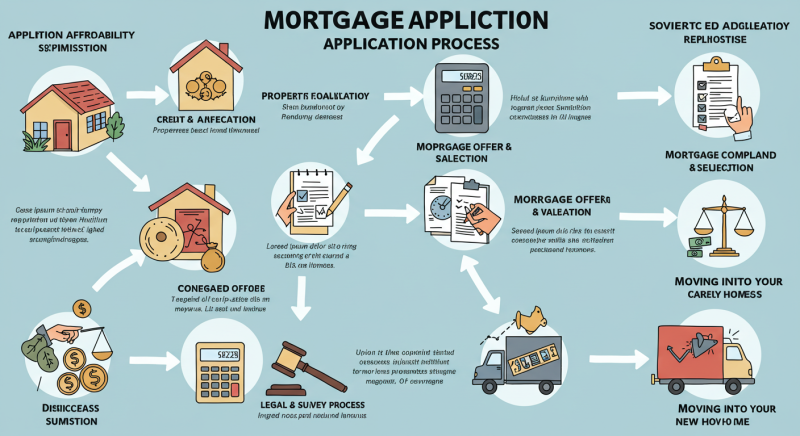

How Mortgage Works in the UK: The Application Process

The journey to securing a mortgage in the UK begins long before you find your dream home. Understanding how mortgage works in the UK means familiarizing yourself with the application process:

Mortgage in Principle

Most prospective homebuyers start by obtaining a Mortgage in Principle (MIP), also known as an Agreement in Principle (AIP) or Decision in Principle (DIP). This preliminary assessment indicates how much a lender might be willing to lend based on initial financial checks. While not a guarantee, an MIP demonstrates to sellers that you’re a serious buyer with likely access to funding. According to data from the Financial Conduct Authority (FCA), buyers with an MIP are approximately 40% more likely to have offers accepted on properties.

Full Mortgage Application

Once you’ve found a property and had an offer accepted, you’ll submit a full mortgage application. This involves a comprehensive assessment of your financial situation, including:

- Affordability Assessment: Lenders evaluate your income against your outgoings to determine how much you can afford to repay each month. Most UK lenders cap lending at 4.5 times your annual income, though this multiple can vary based on individual circumstances.

- Credit Check: A thorough examination of your credit history helps lenders assess the risk of lending to you. Research from Experian suggests that maintaining a good credit score can improve your chances of mortgage approval by up to 50%.

- Property Valuation: The lender arranges a survey to confirm the property’s value, ensuring it provides adequate security for the loan. The Royal Institution of Chartered Surveyors (RICS) reports that approximately 20% of property valuations come in below the agreed purchase price, which can affect mortgage offers.

Types of Mortgages in the UK Market

Understanding how mortgage works in the UK requires familiarity with the various types available:

Interest Rate Structures

- Fixed-Rate Mortgages: Interest rates remain constant for a specified period (typically 2-5 years), providing payment certainty. According to UK Finance, approximately 74% of new mortgages in 2022 were fixed-rate products, reflecting borrowers’ preference for stability in monthly payments.

- Variable-Rate Mortgages: These include tracker mortgages that follow the Bank of England base rate plus a margin, and standard variable rate (SVR) mortgages determined by the lender. Moneyfacts data indicates that the average SVR in early 2024 was approximately 3% higher than the best fixed-rate deals.

- Discount Mortgages: Offering a reduction on the lender’s SVR for a set period, these mortgages can provide lower initial payments but carry the risk of rate increases.

Repayment Methods

- Repayment (Capital and Interest) Mortgages: Each monthly payment reduces both the interest and the capital borrowed, ensuring the loan is fully repaid by the end of the term. FCA statistics show that over 95% of new mortgages are now on a repayment basis.

- Interest-Only Mortgages: Monthly payments cover only the interest, with the capital remaining unchanged. Borrowers must demonstrate a credible strategy to repay the capital at the end of the term. These now account for less than 5% of new residential mortgages, according to the FCA.

The Critical Role of Deposits in UK Mortgages

A fundamental aspect of how mortgage works in the UK is the deposit requirement. This upfront payment represents a percentage of the property’s value that you contribute, with the mortgage covering the remainder. The loan-to-value (LTV) ratio—the percentage of the property’s value you’re borrowing—directly influences the interest rates offered.

Research from mortgage broker Trussle indicates that increasing your deposit from 5% to 10% can reduce your interest rate by approximately 0.5%, potentially saving thousands over the life of the mortgage. The best rates are typically available at 60% LTV or lower, incentivizing larger deposits when possible.

According to Halifax, one of the UK’s largest mortgage lenders, the average first-time buyer deposit in 2023 was approximately £59,000, representing around 20% of the average purchase price. This significant sum highlights why many prospective homeowners spend years saving before entering the property market.

Understanding Mortgage Costs Beyond Interest

When examining how mortgage works in the UK, it’s essential to consider all associated costs:

Arrangement Fees

Most lenders charge an arrangement fee, typically between £500 and £2,000. While some offer “fee-free” mortgages, these usually come with slightly higher interest rates. Analysis by L&C Mortgages suggests that higher fee products with lower interest rates often work out cheaper for larger mortgages, while fee-free products may be more cost-effective for smaller loans.

Early Repayment Charges (ERCs)

Most fixed, discount, and tracker mortgages include ERCs during the initial deal period. These can be substantial—typically 1-5% of the outstanding balance—creating a significant financial penalty for leaving the deal early. According to research from Which?, approximately 32% of borrowers have paid ERCs at some point, with an average cost of £2,300.

Valuation and Survey Fees

Property valuation fees typically range from £150 to £1,500 depending on the property value and the type of survey conducted. While some lenders offer free basic valuations as part of their mortgage package, more comprehensive surveys incur additional costs.

The Mortgage Lifecycle: From Approval to Completion

After your application is approved, understanding how mortgage works in the UK involves navigating several additional steps:

Mortgage Offer

Upon successful application, the lender issues a formal mortgage offer, typically valid for 3-6 months. This document outlines all terms and conditions, including the loan amount, interest rate, monthly repayments, and any special conditions.

Conveyancing Process

Parallel to the mortgage application, your solicitor conducts legal checks on the property, verifying ownership, boundaries, and potential issues. Data from the HomeOwners Alliance suggests this process takes an average of 12 weeks in the UK.

Completion

On completion day, your solicitor transfers the mortgage funds to the seller’s solicitor, and you legally become the property owner. At this point, your mortgage account is activated, and repayments begin according to the schedule specified in your offer.

Strategies for Managing Your UK Mortgage

Effective management of your mortgage can save substantial sums over the loan’s lifetime:

Regular Reviews

Mortgage products typically revert to the lender’s SVR after the initial deal period. Research from MoneySuperMarket indicates that borrowers who actively remortgage every 2-5 years save an average of £3,000 annually compared to those who remain on SVRs.

Overpayments

Most mortgages allow overpayments of up to 10% of the outstanding balance each year without incurring ERCs. Analysis by Santander shows that overpaying by just £100 per month on a £200,000 25-year mortgage could save approximately £12,000 in interest and reduce the term by over three years.

Offset Mortgages

These innovative products link your mortgage to your savings account, with your savings balance effectively reducing the amount of mortgage interest charged. Yorkshire Building Society research suggests that homeowners with significant savings can save up to £15,000 in interest over the life of their mortgage through offset arrangements.

Government Schemes Supporting UK Mortgages

The UK government has introduced various initiatives to help different segments of the population access mortgages:

Help to Buy

While the equity loan scheme closed to new applications in October 2022, existing participants continue to benefit from government loans covering up to 20% of the property value (40% in London). Ministry of Housing data shows that over 355,000 properties were purchased using Help to Buy between its launch in 2013 and its closure.

Shared Ownership

This scheme allows buyers to purchase a share (usually 25-75%) of a property and pay rent on the remainder. According to the National Housing Federation, approximately 200,000 UK households live in shared ownership properties, with the average initial share purchased being 40%.

Mortgage Guarantee Scheme

Introduced to help increase the availability of 95% LTV mortgages, this scheme provides government guarantees to lenders offering high LTV products. HM Treasury reports that over 24,000 households have benefited from this scheme since its reintroduction in April 2021.

The Future of UK Mortgages

The mortgage landscape in the UK continues to evolve in response to economic conditions, technological advances, and changing consumer needs:

Digital Transformation

Traditional mortgage applications typically took 3-6 weeks to process. However, digital-first lenders like Habito and Molo claim to reduce this to as little as 10 days through automated verification processes and streamlined underwriting.

Green Mortgages

As environmental concerns grow, lenders increasingly offer preferential rates for energy-efficient homes. Analysis by Nationwide Building Society indicates that properties with EPC ratings of A or B can access mortgage rates up to 0.3% lower than less efficient properties.

Longer Mortgage Terms

The traditional 25-year mortgage term is gradually being replaced by longer alternatives. UK Finance data shows that approximately 60% of first-time buyers now opt for mortgage terms exceeding 25 years, with 30-35 year terms becoming increasingly common.

Conclusion: Mastering UK Mortgage Knowledge

Understanding how mortgage works in the UK empowers you to make informed decisions about property purchase and financing. From the initial application process through to strategies for efficient repayment, knowledge of the mortgage system can save you thousands of pounds over the life of your loan.

The UK mortgage market offers diverse products catering to various financial situations and preferences. By thoroughly researching options, maintaining strong credit health, and regularly reviewing your mortgage arrangements, you can optimize this significant financial commitment to suit your changing circumstances.

Remember that mortgage products and regulations evolve over time, influenced by economic conditions and policy decisions. Staying informed about these changes—potentially with the support of independent financial advisors—helps ensure your mortgage continues to meet your needs throughout its lifetime.

Frequently Asked Questions (FAQ)

How much deposit do I need for a UK mortgage?

While some mortgages are available with deposits as low as 5%, most lenders offer better rates for deposits of 10% or more. The average first-time buyer deposit is currently around 20% of the property value.

Can I get a mortgage if I’m self-employed?

Yes, but you’ll typically need to provide more evidence of stable income, usually in the form of 2-3 years of accounts or tax returns. Some specialist lenders cater specifically to self-employed applicants.

What’s the difference between a fixed and variable mortgage rate?

Fixed rates remain unchanged for a set period (typically 2-5 years), providing payment certainty. Variable rates can change, either following the Bank of England base rate (trackers) or at the lender’s discretion (SVRs).

How long does it take to get a mortgage approved?

Initial approval can take 1-2 weeks, with the full process from application to completion typically taking 2-3 months, depending on the complexity of your financial situation and the property being purchased.

Can I switch mortgages before my current deal ends?

Yes, but you’ll likely incur early repayment charges. It’s worth calculating whether the savings from switching outweigh these charges or waiting until your current deal’s end date approaches.

How does my credit score affect my mortgage application?

A higher credit score improves your chances of approval and access to better interest rates. Lenders use your credit history to assess the risk of lending and determine the terms they’re willing to offer.

Are interest-only mortgages still available?

Yes, but with stricter criteria than previously. You’ll need to demonstrate a credible repayment strategy and may need a larger deposit (typically 25% or more).

Can I extend my mortgage term to reduce monthly payments?

Most lenders allow term extensions, but this increases the total interest paid over the life of the loan. Some lenders have maximum age limits at the end of the mortgage term (typically 70-85).

What happens if I miss mortgage payments?

Missing payments damages your credit score and could eventually lead to repossession if the situation isn’t resolved. Contact your lender immediately if you anticipate payment difficulties, as they may offer temporary solutions.

How often should I remortgage?

Most borrowers benefit from reviewing their mortgage when their initial deal period ends (typically after 2-5 years) to avoid reverting to higher standard variable rates.

external source

- GOV.UK: Buying or Selling Your Home – Official government guidance on the property buying process, including mortgage information

- Money Helper: Mortgages – Free impartial mortgage advice from the government-backed Money and Pensions Service

- UK Finance Mortgage Trends – Latest statistics on UK mortgage lending and market trends

- Bank of England: Mortgage Rates – Current and historical mortgage interest rates

- Nationwide House Price Index – Monthly updates on UK house prices affecting mortgage affordability

read more