The financial landscape in Nigeria is undergoing a dramatic shift as digital banking trends in Nigeria continue to reshape how millions access financial services. From mobile banking innovations to cryptocurrency adoption, these developments are creating new opportunities for inclusion and growth.

Key Takeaways:

- Nigeria leads Africa in digital banking adoption with over 150 million mobile connections

- Digital banking trends in Nigeria show significant growth in fintech investments, exceeding $200 million in 2024

- Regulatory frameworks are evolving to accommodate new digital banking models

- Traditional banks are partnering with fintechs to remain competitive

- Security challenges remain a concern despite technological advancements

The Digital Revolution Sweeping Across Nigeria’s Banking Sector

When Adeola, a small business owner in Lagos, recalls banking just five years ago, she describes long queues, stacks of paperwork, and entire days lost to simple transactions. Today, she manages her entire business from her smartphone. This transformation exemplifies the remarkable digital banking trends in Nigeria that have fundamentally altered the country’s financial ecosystem.

Nigeria’s digital banking sector is experiencing unprecedented growth, with adoption rates surpassing many global markets. The digital banking trends in Nigeria show a financial landscape transitioning rapidly from traditional brick-and-mortar operations to innovative, technology-driven solutions. With approximately 150 million mobile connections in a country of 200 million people, the foundation for digital financial services is firmly established, according to the Nigerian Communications Commission’s 2024 industry report.

The Rise of Neobanks: Nigeria’s Digital-Only Banking Revolution

One of the most significant digital banking trends in Nigeria is the emergence of neobanks – financial institutions operating exclusively online without physical branches. Companies like Kuda, Carbon, and Sparkle have attracted millions of customers by offering zero or minimal fees, intuitive interfaces, and services tailored to the Nigerian market.

“Banking should be as easy as using social media,” says Tunde Kehinde, a fintech entrepreneur based in Lagos. “The latest digital banking trends in Nigeria show consumers want simplicity, transparency, and accessibility – exactly what neobanks provide.”

These digital-only banks have secured substantial funding, with investment in Nigerian fintech exceeding $200 million in 2024 alone, according to recent industry reports. This investment surge reflects growing confidence in the sustainability of digital banking trends in Nigeria and their potential to address longstanding financial inclusion challenges.

Mobile Money and Payment Innovations Transforming Transactions

If you’ve visited any Nigerian market recently, you’ve likely noticed the conspicuous absence of something once ubiquitous – cash. The rapid adoption of mobile payment solutions represents one of the most visible digital banking trends in Nigeria affecting everyday transactions.

Payment services like Paystack, Flutterwave, and OPay have revolutionized how Nigerians send and receive money. Interoperability between platforms has improved dramatically, allowing seamless transfers between different banks and payment services – a significant advancement in digital banking trends in Nigeria that promotes financial inclusivity.

The Central Bank of Nigeria reports that mobile transactions increased by over 150% between 2023 and 2025, with monthly transaction values now exceeding ₦20 trillion, according to the CBN Statistical Bulletin on Payment Systems.

Regulatory Environment and Government Initiatives

The Nigerian government and regulatory bodies have played crucial roles in enabling digital banking trends in Nigeria through progressive policies. The Central Bank of Nigeria’s framework for licensing Payment Service Banks (PSBs) has allowed telecommunications companies and other non-traditional players to offer financial services, expanding the ecosystem.

Additionally, the implementation of the Bank Verification Number (BVN) system has strengthened identity verification, addressing a critical challenge in digital banking security. These regulatory developments have created a more structured environment for digital banking trends in Nigeria to flourish while protecting consumers.

Nevertheless, industry stakeholders continue to advocate for more flexible regulations. “We need regulatory frameworks that evolve as quickly as digital banking trends in Nigeria,” explains Dr. Yele Okeremi, a fintech policy analyst. “The challenge is balancing innovation with necessary consumer protections.”

Traditional Banks’ Digital Transformation Journey

Established financial institutions aren’t sitting idly as digital banking trends in Nigeria reshape the landscape. Traditional banks like GTBank, First Bank, and Access Bank have invested heavily in digital transformation, launching competitive mobile applications and internet banking platforms.

These institutions are leveraging their existing customer base and banking licenses to compete with fintechs. The digital banking trends in Nigeria have prompted many traditional banks to establish innovation labs and venture capital arms to invest in promising startups, creating a collaborative ecosystem rather than purely competitive dynamics.

First Bank’s FirstMonie agent banking network exemplifies how traditional institutions are adapting to digital banking trends in Nigeria by combining physical presence with digital capabilities, particularly in underserved rural areas where technology infrastructure remains challenging.

Cryptocurrency and Blockchain Adoption

Despite regulatory uncertainties, cryptocurrency usage represents one of the most fascinating digital banking trends in Nigeria. The country consistently ranks among the top global markets for cryptocurrency adoption, with millions of Nigerians using digital currencies for remittances, investments, and hedging against inflation.

A 2024 Chainalysis Global Crypto Adoption Index report places Nigeria among the top five countries globally for peer-to-peer cryptocurrency trading volume. Blockchain technology extends beyond cryptocurrencies, with applications emerging in identity verification, property rights, and supply chain management. These implementations demonstrate how digital banking trends in Nigeria are exploring technologies with transformative potential beyond traditional financial services.

“When Nigerians discovered they could send money abroad instantly without exorbitant fees, cryptocurrency adoption exploded,” notes Binance’s regional representative. “It’s a perfect example of how digital banking trends in Nigeria are often driven by practical needs rather than technological fascination.”

How to Navigate Nigeria’s Digital Banking Revolution

Selecting the Right Digital Banking Services

To make the most of current digital banking trends in Nigeria, consumers should evaluate digital banking options based on:

Security features and history of protecting customer data represent the most critical consideration when exploring digital banking trends in Nigeria. Look for institutions that implement multi-factor authentication, end-to-end encryption, and have clear data protection policies.

Fee structures vary significantly across platforms. Some neobanks offer zero-fee accounts but may charge for specific transactions. Understanding these nuances helps maximize the benefits of digital banking trends in Nigeria for your personal finances.

Feature alignment with your specific needs should guide your choice among the various digital banking trends in Nigeria. Someone conducting international business requires different capabilities than someone primarily making domestic transactions.

Protecting Yourself in the Digital Banking Ecosystem

As digital banking trends in Nigeria accelerate, cybersecurity awareness becomes increasingly important. Protect yourself by:

Never sharing authentication details like OTPs or passwords, regardless of how legitimate a request may seem. The rapid evolution of digital banking trends in Nigeria has unfortunately been accompanied by sophisticated phishing attempts.

Regularly updating banking applications ensures you have the latest security patches. The dynamic nature of digital banking trends in Nigeria means that security protocols are constantly evolving to address emerging threats.

Monitoring your accounts for unauthorized transactions allows for quick responses to potential breaches. Despite advances in security technologies, vigilance remains essential as digital banking trends in Nigeria create new potential vulnerabilities alongside benefits.

Digital Financial Inclusion: Reaching the Unbanked

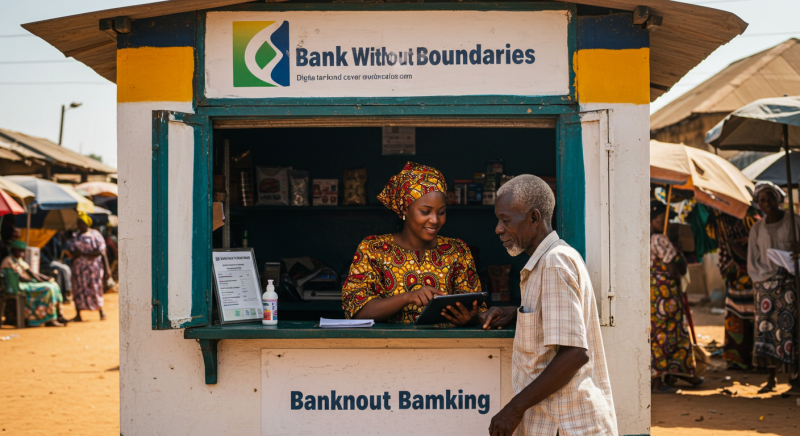

Perhaps the most profound impact of digital banking trends in Nigeria has been on financial inclusion. With traditional banking infrastructure concentrated in urban centers, millions of Nigerians previously had limited access to financial services. Digital innovations are bridging this gap.

Agent banking networks have expanded dramatically, with over 1.5 million agents nationwide providing cash-in/cash-out services, account opening, and other basic banking functions, according to EFInA’s 2024 Financial Inclusion Report. This expansion represents how digital banking trends in Nigeria are adapting to accommodate varying levels of technological readiness across the population.

Services designed specifically for feature phones ensure that smartphone ownership isn’t a prerequisite for participation in the digital economy. This adaptability demonstrates how digital banking trends in Nigeria are evolving to address the country’s unique demographic and infrastructure challenges.

Challenges and Future Directions

Despite impressive progress, digital banking trends in Nigeria face significant challenges. Infrastructure limitations, particularly inconsistent internet connectivity and electricity supply, continue to impede adoption in many regions. Financial literacy remains another barrier, with many potential users unfamiliar with digital tools.

Looking ahead, emerging digital banking trends in Nigeria suggest several exciting developments:

Artificial intelligence and machine learning applications are likely to enhance credit scoring models, potentially unlocking financing for previously excluded segments. These technologies represent the next frontier in digital banking trends in Nigeria by enabling more sophisticated risk assessment beyond traditional metrics.

Open banking frameworks, though still developing, promise to revolutionize how financial data is shared and utilized. This evolution in digital banking trends in Nigeria could enable more personalized financial services and greater competition among providers.

Embedded finance—integrating financial services into non-financial platforms—represents another promising direction. As digital banking trends in Nigeria continue to evolve, we may see banking functions seamlessly integrated into e-commerce, transportation, and other everyday services.

Conclusion: Nigeria’s Digital Banking Future

The digital banking trends in Nigeria paint a picture of a financial ecosystem in transformation—one that’s increasingly accessible, efficient, and innovative. From market traders using QR codes for daily transactions to sophisticated investment platforms democratizing access to capital markets, technology is reshaping financial services at every level.

While challenges remain, the trajectory is clear. Nigeria is positioning itself as Africa’s digital banking laboratory, where unique solutions to unique challenges are creating models with global relevance. As digital banking trends in Nigeria continue to evolve, they promise to create a more inclusive, efficient financial system capable of supporting the country’s economic aspirations.

For consumers, businesses, and investors alike, understanding these digital banking trends in Nigeria isn’t just academically interesting—it’s essential for navigating the country’s rapidly changing financial landscape. The revolution isn’t coming; it’s already here, one transaction at a time.

Frequently Asked Questions (FAQ)

What are the main digital banking trends in Nigeria currently?

The main digital banking trends in Nigeria include the rise of neobanks (digital-only banks), mobile payment innovations, increased cryptocurrency adoption, traditional banks’ digital transformation, and expanding agent banking networks for greater financial inclusion.

How secure are digital banking platforms in Nigeria?

Digital banking platforms in Nigeria implement various security measures including encryption, multi-factor authentication, and fraud monitoring systems. However, users should remain vigilant against phishing attempts and regularly update their applications to maintain security.

Can I use digital banking services without a smartphone?

Yes, many providers have developed USSD-based services that work on feature phones without internet connectivity, though with more limited functionality. This approach ensures digital banking trends in Nigeria benefit citizens across all socioeconomic levels.

What regulations govern digital banking in Nigeria?

Digital banking in Nigeria is primarily regulated by the Central Bank of Nigeria (CBN) through various frameworks including the PSB licensing guidelines, cybersecurity standards, and KYC/AML requirements. The regulatory environment continues to evolve alongside digital banking innovations.

How are traditional banks responding to fintech competition?

Traditional banks are investing heavily in digital transformation, launching competitive mobile applications, establishing innovation labs, partnering with fintechs, and leveraging their existing customer base and banking licenses to remain relevant in Nigeria’s changing financial landscape.

READ MORE

Visa-Free Countries for Nigerian Passport Holders: Your Ultimate 2025 Travel Guide