Seedstars Africa Ventures deploys initial checks from US $250,000 to US $2 million in Seed and Series A rounds, with follow-on capacity up to US $5 million, combining flexible syndication terms and local on-the-ground expertise across more than 25 African markets Seedstars Africa VenturesSeedstars. This guide synthesizes the latest data and insider recommendations to help you accelerate your funding journey.

Introduction

Securing capital can feel like standing at the edge of a vast ocean—heart pounding, dreams afloat—yet knowing how to secure funding from Seedstars Africa Ventures can transform apprehension into boundless opportunity.

Key Takeaways

you’ll learn how to secure funding from Seedstars Africa Ventures starting with clear criteria, how building relationships can define your path, and why a polished pitch is essential in how to secure funding from Seedstars Africa Ventures. You’ll also grasp the streamlined process timelines and the importance of follow-up for how to secure funding from Seedstars Africa Ventures.

Understanding Seedstars Africa Ventures

Seedstars Africa Ventures I, launched in 2024, is a generalist early-stage VC fund powered by Seedstars, with initial check sizes of up to US $2 million and follow-ons up to US $5 million, aiming to address gaps in seed financing across Sub-Saharan Africa and provide a blueprint on How to Secure Funding from Seedstars Africa Ventures. SeedstarsIncubees

The fund’s US $42 million first close at the Africa Investment Forum Market Days underscores its strong backing from LPs including EIB Global’s US $30 million commitment and AfDB’s strategic partnership, demonstrating why entrepreneurs should focus on How to Secure Funding from Seedstars Africa Ventures.

Active in more than 25 African countries—from West to East—with thematic focus on digital solutions in fintech, agritech, cleantech, healthcare, and education, founders seeking insight on How to Secure Funding from Seedstars Africa Ventures must demonstrate regional scalability and sector alignment. SeedstarsEuropean Investment Bank

The fund’s 10+2 year structure offers a five-year investment period followed by a five-year exit phase, emphasizing the importance of understanding long-term commitments when learning How to Secure Funding from Seedstars Africa Ventures. African Development BankEuropean Investment Bank

Led by General Partner Bruce Nsereko-Lule in Nairobi and GP/MD Tamim El Zein, the team provides hands-on support, mentorship, and access to a global ecosystem—key factors for startups wishing to know How to Secure Funding from Seedstars Africa Ventures. SeedstarsOpenVC

Portfolio highlights such as Beacon Power Services in Nigeria and fintech innovator Flutterwave in early stages illustrate the fund’s ability to catalyze growth, offering compelling case studies on How to Secure Funding from Seedstars Africa Ventures through traction and impact metrics. AVCATech & Data for VC & Investment Banks

Through tailored syndication and flexible deal terms, the fund can co-invest with local and international partners, underlining strategic considerations for founders seeking advice on How to Secure Funding from Seedstars Africa Ventures. Seedstars Africa VenturesTech Funding News

Backed by the European Union’s ACP Trust Fund via the Boost Africa program, Seedstars Africa Ventures has institutional credibility, which is critical for entrepreneurs to understand when preparing applications on How to Secure Funding from Seedstars Africa Ventures.

As part of the Seedstars group, the fund leverages extensive acceleration programs and deal flow generated through startup competitions and events, which can give founders an edge in How to Secure Funding from Seedstars Africa Ventures by participating in ecosystem initiatives.

Crafting Your Pitch to Master How to Secure Funding from Seedstars Africa Ventures

A compelling pitch is the cornerstone of how to secure funding from Seedstars Africa Ventures, as it serves to spark investor interest and secure that crucial first meeting. Most investors review dozens of decks weekly, so brevity and clarity are paramount when demonstrating why your startup aligns with Seedstars’ mission-driven approach to African innovation Seedstars.

Begin your pitch with a concise Introduction slide that clearly states who you are, what your business does, and why it is uniquely positioned for success—essential steps in how to secure funding from Seedstars Africa Ventures Lionesses of Africa. This emotional yet factual opener sets the tone and immediately ties into Seedstars’ emphasis on both economic returns and social impact across Africa LinkedIn.

Structure Your Deck for Maximum Impact

Limit your deck to 15–20 slides, each featuring no more than 3–5 bullet points, to respect investors’ limited attention spans and to facilitate rapid comprehension of how to secure funding from Seedstars Africa Ventures Seedstars. Organize slides to follow a logical flow:

-

Problem Definition – Articulate the specific challenge your target market faces, demonstrating clear relevance to the African context and why solving this problem is vital for regional development, a key focus in how to secure funding from Seedstars Africa Ventures LinkedIn.

-

Solution & Value Proposition – Showcase how your product or service uniquely addresses the problem, backing claims with early user feedback or prototype results to reinforce credibility in how to secure funding from Seedstars Africa Ventures LinkedIn.

-

Market Opportunity – Quantify market size and growth potential, emphasizing regional scalability across the 25+ countries where Seedstars operates, which is critical for demonstrating viability in how to secure funding from Seedstars Africa Ventures LinkedIn.

-

Traction & Metrics – Present key performance indicators—such as MAU, MRR or customer acquisition cost—that illustrate momentum; strong traction is one of the most persuasive elements when proving your startup is ready for Seedstars’ seed or Series A check Ink Narrates.

-

Business Model & Financials – Outline revenue streams, unit economics, and three-to-five-year financial forecasts, reinforcing how to secure funding from Seedstars Africa Ventures by showing clear paths to profitability and attractive return multiples Kruze Consulting.

-

Team & Advisors – Highlight founders’ backgrounds, domain expertise, and key advisors, demonstrating why your team can execute the vision, a crucial factor for mastering how to secure funding from Seedstars Africa Ventures Seedstars.

-

Investment Ask & Use of Funds – State the exact amount you are raising, how funds will be allocated, and projected milestones, explicitly linking this to your plan for growth within the African markets Seedstars targets, a best practice for how to secure funding from Seedstars Africa Ventures LinkedIn.

Tailor Your Narrative to Seedstars’ Ethos

Seedstars Africa Ventures values ventures that combine scalability with social impact, so weave stories of how your solution empowers local communities or addresses systemic challenges—this narrative alignment is key to understanding how to secure funding from Seedstars Africa Ventures LinkedIn. Incorporate examples of partnerships or pilots in African markets to underscore authenticity and regional relevance in how to secure funding from Seedstars Africa Ventures Seedstars.

Design & Delivery: Polished but Personable

Use clean visuals, consistent branding, and simple charts to communicate data without distraction—keeping to their slide-and-bullet guidelines enhances readability and reinforces your grasp of how to secure funding from Seedstars Africa Ventures Seedstars. Practice delivering your pitch within 7–10 minutes, allowing ample time for investor questions; confident storytelling and concise answers further demonstrate preparedness for engagement on how to secure funding from Seedstars Africa Ventures LinkedIn.

By meticulously structuring your deck, tailoring your message to Seedstars’ values, and rehearsing your delivery, you will significantly improve your chances to master how to secure funding from Seedstars Africa Ventures and catalyze your startup’s growth across Africa.

Leveraging Networks to Enhance How to Secure Funding from Seedstars Africa Ventures

By engaging Seedstars’ extensive alumni and mentorship ecosystem, attending curated industry events and pitch competitions, partnering with local innovation hubs and accelerators, and tapping into global online platforms, startups can build the credibility, referrals, and insider insights required to master how to secure funding from Seedstars Africa Ventures SeedstarsSeedstarspitchwise.seVC4AAFDChoose AfricaVC4Apitchwise.se.

Tapping into Seedstars’ Alumni and Mentorship Ecosystem

Seedstars works with over 250,000 community members—founders, mentors, and investors—providing direct access to alumni who have successfully raised rounds and can offer warm introductions, a critical step in how to secure funding from Seedstars Africa Ventures Seedstars.

Their tailored acceleration programs include hands-on mentorship and peer learning workshops, enabling entrepreneurs to refine pitches, sharpen due diligence readiness, and confidently pursue how to secure funding from Seedstars Africa Ventures Seedstars.

Additionally, free mentorship initiatives like the Google for Startups Black Founders Fund offer structured guidance and networking sessions, exemplifying how strategic mentor connections can accelerate your journey on how to secure funding from Seedstars Africa Ventures Tech In Africa.

Complementary funding and mentorship guides available on LinkedIn spotlight the importance of leveraging expert advice to position your startup effectively for how to secure funding from Seedstars Africa Ventures LinkedIn.

Engaging at Industry Events and Pitch Competitions

Industry conferences and pitch meetups remain prime opportunities to build relationships before formal funding asks—an indispensable lesson in how to secure funding from Seedstars Africa Ventures pitchwise.se.

Seedstars-hosted events, from local demo days to the global Seedstars Summit, provide forums to showcase your solution, gain real-time feedback, and secure referrals directly aligned with how to secure funding from Seedstars Africa Ventures Seedstars.

Likewise, high-profile gatherings such as the Invest in Africa Summit attract LPs and co-investors, enabling you to network with potential backers and demonstrate the robust connections that underpin how to secure funding from Seedstars Africa Ventures VC4A.

Partnering with Local Hubs and Accelerators

Local partner funds under programs like AFD’s Digital Africa seed fund strengthen startups’ ecosystems, granting access to early-stage financing and expert networks essential for how to secure funding from Seedstars Africa Ventures AFD.

Programs such as Choose Africa tap regional VC firms and development finance partners, illustrating how collaborations with local accelerators can elevate your entrepreneurial profile in Africa and improve your strategy for how to secure funding from Seedstars Africa Ventures Choose Africa.

These partnerships not only provide localized market insights but also generate co-investment prospects and due diligence support when applying for rounds with Seedstars Africa Ventures.

Utilizing Online Platforms and Global Communities

Digital platforms like VC4A connect founders with mentors, investors, and fellow entrepreneurs across continents, offering an avenue to cultivate the global endorsements needed to learn how to secure funding from Seedstars Africa Ventures VC4A.

Pitchwise recommends starting with local networks before scaling outreach via online communities—this phased approach builds credibility and yields introductions instrumental to how to secure funding from Seedstars Africa Ventures pitchwise.se.

Participation in virtual masterclasses and webinars hosted by ecosystem players further broadens your reach, enabling you to showcase traction news, gather insights, and translate digital engagement into invitations to Seedstars’ review process.

Building Long-Term Relationships through Follow-Ups

Networking is not a one-off activity but an ongoing dialogue: following up within 48 hours after events, sharing relevant updates, and offering mutual value are proven tactics in how to secure funding from Seedstars Africa Ventures pitchwise.se.

Cultivating these connections over time ensures that when you formally enter Seedstars’ funnel, you do so with advocates who can vouch for your startup’s potential, dramatically enhancing your probability of success.

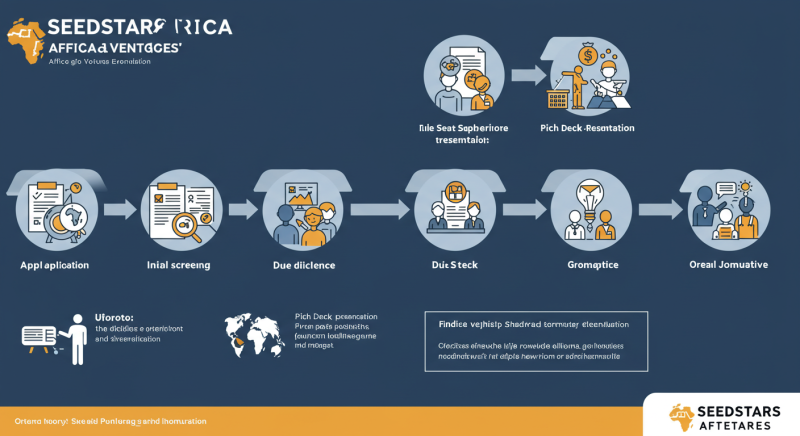

Navigating the Application Process for How to Secure Funding from Seedstars Africa Ventures

Preparing Your Application Materials

To begin learning how to secure funding from Seedstars Africa Ventures, assemble a concise pitch deck, a clear executive summary, and realistic financial projections that highlight your traction and scalability within African markets ProDevs.

Ensure your materials explicitly address Seedstars Africa Ventures’ investment criteria—highlighting digital innovation, market potential across their 25+ markets, and measurable social impact—to align with how to secure funding from Seedstars Africa Ventures ProDevs.

Submission and Initial Screening

Start by completing the online application form on the Seedstars Africa Ventures website, detailing your business model, team composition, and funding ask—this first step is essential for understanding how to secure funding from Seedstars Africa Ventures Seedstars Africa Ventures.

Within a few days of submission, the Seedstars team will review your application and respond if your startup matches their thematic focus and stage, marking the initial phase of how to secure funding from Seedstars Africa Ventures Seedstars.

First Call: 30-Minute Discovery

If invited, you’ll have a 30-minute introductory call designed to explore your venture’s mission, technology, and market opportunity—this live interaction is a critical component of how to secure funding from Seedstars Africa Ventures Seedstars.

Use this call to demonstrate your team’s expertise, answer clarifying questions promptly, and reaffirm why your startup embodies the fund’s dual objectives of return generation and job creation, further advancing your strategy for how to secure funding from Seedstars Africa Ventures Seedstars.

Second-Round Interview: Deep Dive

Successful first‐round candidates proceed to a comprehensive second interview with the full founding team, where investors assess your operational readiness, governance structure, and growth milestones—key insights for mastering how to secure funding from Seedstars Africa Ventures Seedstars.

Prepare detailed responses on your unit economics, customer acquisition strategy, and ESG considerations, as Seedstars Africa Ventures places heavy emphasis on impact metrics alongside financial returns

Investment Committee Review and Decision

After your pitch meetings, your dossier moves to the investment committee, which typically convenes within one to two weeks to evaluate term sheets, due diligence findings, and alignment with fund objectives—this stage finalizes your understanding of how to secure funding from Seedstars Africa Ventures Seedstars.

Upon a positive committee decision, you will receive a term sheet outlining investment amount, equity stake, and co-investor syndication terms, concluding the core process on how to secure funding from Seedstars Africa Ventures Africa Investment Forum.

Closing the Deal

Once terms are agreed, legal documentation is prepared and signed, and funds are disbursed according to your agreed milestones—this closing phase transforms preparation into capital, realizing your goal of how to secure funding from Seedstars Africa Ventures TechCrunch.

Timeline Expectations

From application to signed term sheet, the entire journey can be completed in as little as one to two weeks if all materials and calls proceed smoothly—knowing these timeframes is essential for anyone charting how to secure funding from Seedstars Africa Ventures Seedstars.

By following each of these steps diligently—tailoring your documents, engaging effectively on calls, and respecting committee schedules—you’ll be well-equipped to navigate the application process and secure funding from one of Africa’s premier early-stage investors.

Conclusion

Mastering how to secure funding from Seedstars Africa Ventures requires preparation, strategic alignment, and proactive engagement. By understanding their criteria, crafting a data-driven pitch, leveraging relationships, and respecting timelines, you position your startup for success with one of Africa’s leading early-stage funds.

FAQ

What stages does Seedstars Africa Ventures fund?

Seedstars Africa Ventures targets Seed and Series A rounds, with initial checks from US $250K to US $2M and follow-ons up to US $5M Seedstars.

Which sectors are preferred?

They focus on high-growth SMEs leveraging digital tech across agribusiness, climate, fintech, energy, and communications Dakota Homepage 2025.

How long is the application process?

Typically one to two weeks, including a first call, second interview, and committee decision Seedstars.

Do they lead rounds?

Yes, Seedstars Africa Ventures prefers lead or co-lead positions to add strategic value to rounds Seedstars Africa Ventures.

Can non-African startups apply?

Startups must be based in or addressing African markets to align with the fund’s regional mandate.

READ more

How I Landed a $20,000 Scholarship: My Winning Approach